Zim Now Business Desk | July 9, 2025

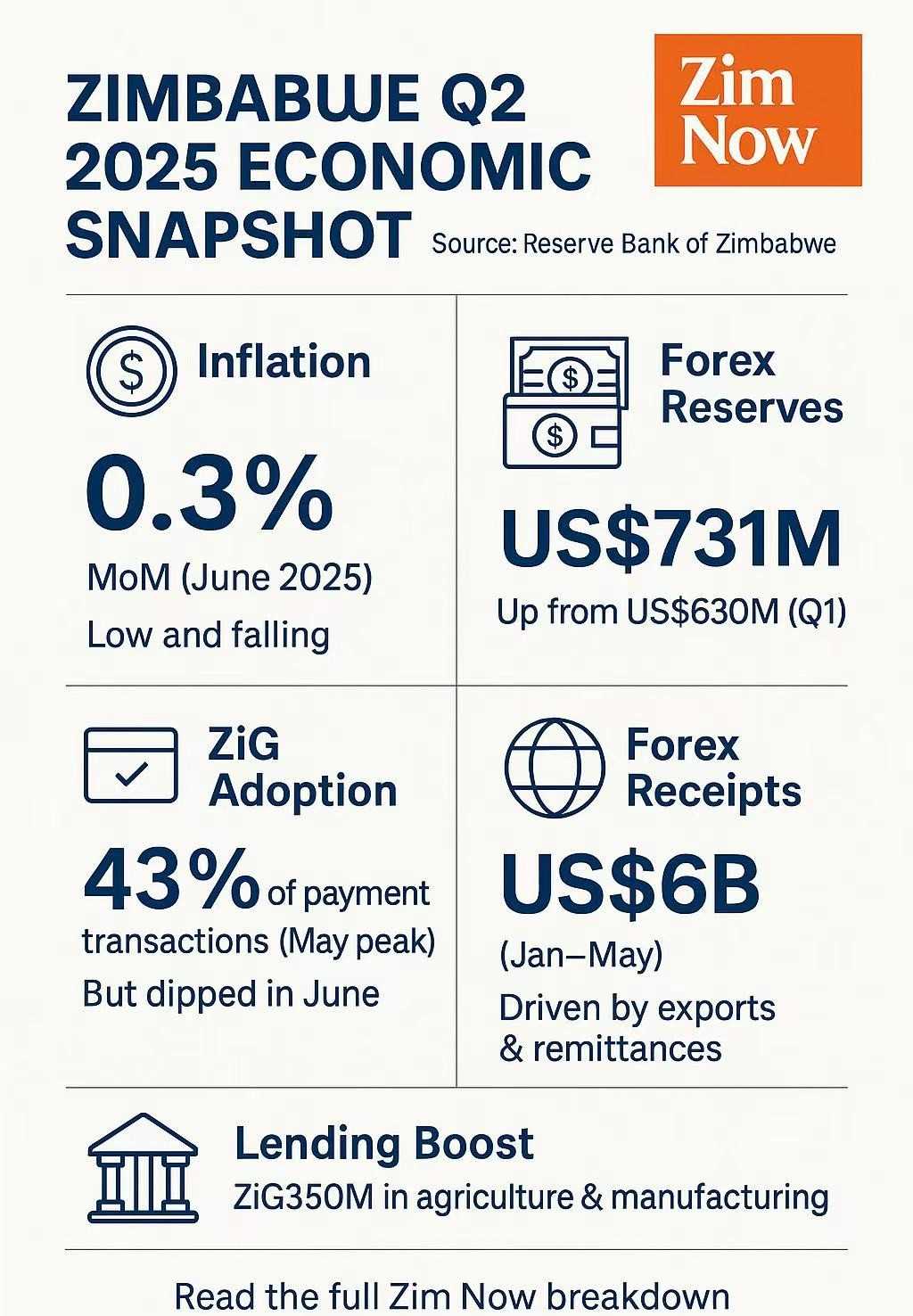

Zimbabwe’s Reserve Bank is standing firm on its tight monetary policy path, citing strong signals that the strategy is bearing fruit. According to the Q2 2025 Monetary Snapshot released on July 8, the country is witnessing a period of exchange rate stability, declining inflation, and a surge in foreign currency reserves—all critical pillars for restoring confidence in the recently introduced ZiG currency.

Inflation Falls as Monetary Policy Bites

Month-on-month inflation dropped to 0.3% in June, down from 0.9% in May, with the central bank noting an average of just 0.5% since February. The Reserve Bank of Zimbabwe attributes this decline to its tight liquidity controls, a key component of its broader plan to anchor inflation expectations and support price stability.

Despite year-on-year inflation climbing to 92.5% in June, largely due to a base effect from the October 2024 spike, RBZ forecasts a significant drop to below 30% by December 2025.

“Economic agents are encouraged to focus on month-on-month inflation as a more accurate reflection of purchasing power and current price dynamics,” the central bank said.

Forex Reserves Rise to Support ZWG

One of the most notable developments is the increase in foreign currency reserves, which rose from US$630 million in Q1 to US$731 million in Q2. These reserves—composed of gold, cash holdings, and Nostro balances—now cover more than three times the reserve money stock of ZWG, which the RBZ says is vital for maintaining long-term confidence in the currency.

Forex receipts from January to May hit US$6 billion, up from US$4.9 billion over the same period in 2024. These were driven largely by export earnings (55.9%), loan proceeds (18.4%), and diaspora remittances (15.4%).

RBZ estimates monthly surpluses of around US$378 million, a cushion that not only enables import cover but also strengthens the central bank’s ability to stabilize the exchange rate.

ZWG Adoption Growing—But Still Uneven

The use of ZiG in domestic transactions showed encouraging signs, climbing from 32% in April to a peak of 43% in May before dipping to 35% in June. The RBZ has rolled out more POS machines, coins, and notes to drive up local currency usage.

While the figures suggest some growing confidence in the domestic currency, the June dip also signals volatility in public trust and the ongoing tug-of-war between ZiG and the US dollar in the marketplace.

Targeted Lending to Real Economy

The Targeted Finance Facility, introduced in February, has disbursed a total of ZiG350 million in credit to productive sectors. Agriculture received the largest share (44.8%), followed by manufacturing (34.7%), indicating a strategic tilt towards real economy growth.

The ZiG loan-to-deposit ratio has also risen steadily, from below 30% in April 2024 to 45% in May 2025, suggesting growing business willingness to transact in the local currency.

Exchange Rate Holds Steady

The official interbank rate remained stable at ZiG26.95 to the US dollar, with the Willing Buyer-Willing Seller platform reportedly meeting formal import demand. The central bank credits this to sufficient forex supply and a contained parallel market premium.

Outlook: Stability, But Confidence Still Fragile

RBZ remains optimistic about achieving its 6% real GDP growth target for 2025, provided the current policy path is maintained. However, much depends on sustained forex inflows, public trust in the ZiG, and how effectively the government manages structural reforms alongside monetary measures.

While signs of macroeconomic stability are evident on paper, the real test lies in day-to-day confidence—whether citizens and businesses alike are willing to back the ZiG, not just because they are told to, but because they believe it works.

Leave Comments